Moody's Us Treasury Bond Rating

moodys treasury wallpaperThen at the prompt dial 866-330-MDYS 866-330-6397. Moodys Places Twelve Bond Fund Ratings On Review for Possible Downgrade.

From February 18 2002 to February 8 2006 Treasury published.

Moody's us treasury bond rating. Moodys Investors Service fired off a warning on Wednesday that the triple A sovereign credit rating of the US would come under pressure unless economic growth was more robust than expected or. Graph and download economic data for Moodys Seasoned Aaa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity AAA10Y from 1983-01-03 to 2021-02-10 about AAA spread 10-year maturity bonds Treasury yield corporate interest rate interest rate and USA. Or that replace a previously assigned provisional rating at the same rating level Moodys publishes a rating announcement on that series categoryclass of debt or program as a whole on the support provider or primary rated entity or on the provisional rating but often.

Find the latest ratings reports data and analytics on US Treasury Securities. Then at the prompt dial 866-330-MDYS 866-330-6397. Graph and download economic data for Moodys Seasoned Baa Corporate Bond Yield BAA from Jan 1919 to Jan 2021 about Baa bonds yield corporate interest rate interest rate and USA.

The rating groups. Like Moodys Fitch has kept its top AAA-rating on US. Until April-May 2010 Moodys and Fitch were rating municipal bonds on the separate namingclassification system which mirrored the tiers for corporate bonds.

The lower the number the higher-end the rating. SP abolished its dual rating system in 2000. Moodys is another credit and bond rating agency accredited by NRSRO.

American financial markets were unnerved yesterday by the news that Moodys credit rating agency might downgrade a chunk of the US governments Treasury bonds. It cited its high level of debt. 30-year Treasury constant maturity series was discontinued on February 18 2002 and reintroduced on February 9 2006.

The 2-month constant maturity series begins on October 16 2018 with the first auction of the 8-week Treasury bill. Board of Governors of the Federal Reserve System FRB for the H15 Selected Interest Rates D W M release. US jobs data point to modest recovery but also continued distress in worst-hit sectors 05 Feb 2021 Moodys Investors Service The January US jobs report reinforces two contrasting themes in the countrys economic recovery stuttering improvement in labor market conditions and growth and still-acute distress among the sectors and workers hardest hit by the coronavirus pandemic.

According to Moodys the purpose of its ratings is to provide investors with a simple system of gradation by which future relative creditworthiness of securities may be gauged To each of its ratings from Aa through Caa Moodys appends numerical modifiers 1 2 and 3. Dial the ATT Direct Dial Access code for. This page provides forecast and historical data charts statistics news and updates for United States Treasury Bills over 31 days.

The company covers more than 135 sovereign nations 5000 non-financial corporate issuers 4000 financial institutions 18000 public finance issuers 11000 structured finance transactions and 1000 infrastructure and project finance issuers. Treasury Bills over 31 days for United States from US. SSgA US Treasury Money Market Fund.

Securities and Exchange Commission SEC retained the USs triple-A rating. US junk bonds may fall significantly after a rally this year that has left the riskier end of the corporate bond market in a perilous state Moodys has warned. Reuters - Ratings agency Moodys on Wednesday maintained the United States top-notch Aaa credit rating saying the countrys exceptional economic strength would counterbalance lower fiscal.

Both Fitch Ratings and Moodys designated like SP as nationally recognized statistical rating organizations NRSRO by the US. However Standard Poors downgraded the US rating by one notch to AA in August 2011. The benchmark 30-year Treasury bond.

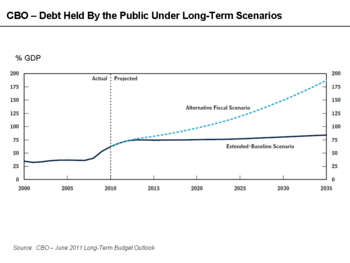

Moodys however changed its outlook to negative on June 2 2011 and Fitch changed its outlook to negative on November 28 2011. Dial the ATT Direct Dial Access code for. Municipal bonds are instruments issued by local state or federal governments in the United States.

Moodys assigns AaaMR1 ratings to iShares US dollar Treasury Bond 1-3 year Exchange-Traded Fund.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)